Axxes Fund Solutions

Our offerings will concentrate on what we believe to be the most attractive investment opportunities in the private market universe overseen by top-tier managers previously only accessible to the largest institutions.

- Private Equity Co-Investments, Secondaries and Credit

- Direct Lending

- Real Estate Equity and Debt

- Distressed Credit

- Leveraged Buyouts and Control Investments

- Venture Capital

Introducing Axxes Direct by Axxes Capital

Axxes Direct is an industry-first platform seeking to provide advisors with high-quality and vetted co-investment and continuation vehicle opportunities across the spectrum of private asset classes. Our vision at Axxes Capital is to level the playing field for individual investors seeking access to top-tier investment opportunities that are otherwise only available to institutional investors.

Axxes Direct Seeks to Unlock Exclusive Co-Investment Opportunities for Qualified Purchasers

Axxes Direct is an industry-first platform providing advisors with high-quality and vetted co-investment and continuation vehicle opportunities across the spectrum of private asset classes.

Our Target Strategies

Private Equity

- — Co-Investments

- — Secondaries

- — Continuation Vehicles (GP-Led Secondaries)

Real Estate Co-Investments

Special Situations

- Private Equity Co-Investments & Secondaries

- — Co-Investments

- — Secondaries

- — Continuation Vehicles (GP-Led Secondaries)

- Credit & Special Situations

- Real Estate Co-Investments

Our Private Equity & Co-Investments Strategy engages in highly-selective co-investments with established private equity firms focused on middle-market companies. We are industry agnostic, and target companies with robust EBITDA margins, healthy growth trajectories, defensible market positions, and strong barriers to entry, ensuring each investment possesses compelling equity and debt underwriting characteristics.

Axxes Special Situations will explore unique investment opportunities across various asset classes, including private equity, credit, and real estate. These investments often involve elements of restructuring or turnaround, offering distinctive opportunities in evolving market conditions.

Axxes Real Estate Co-Investments partner with seasoned developers for the acquisition, repositioning, and development of properties. Our focus is on assets that generate steady income, meet local demands, and offer clear prospects for utilization, occupancy, and growth in rental income.

Private Equity Co-Investments & Secondaries

Axxes will engages in strategic co-investments with established private equity firms, focusing on industry-agnostic, middle-market companies. We target entities with robust EBITDA margins, defensible market positions, and strong barriers to entry, ensuring each investment possesses compelling equity and debt characteristics.

Real Estate Co-Investments

Axxes Real Estate Co-Investments will seek to partner with seasoned developers for the acquisition, repositioning, and development of properties. Our focus is on assets that generate steady income, meet local demands, and offer clear prospects for utilization, occupancy, and growth in rental income.

Special Situations

Axxes Special Situations will explore unique investment opportunities across various asset classes, including private equity, credit, and real estate. These investments often involve elements of restructuring or turnaround, offering distinctive opportunities in evolving market conditions.

What We Offer

Direct Access

- Once established, through Axxes Direct, advisors and their clients can directly access single-asset continuation vehicles, real estate investments, and co-investment opportunities. Previously, these opportunities were only provided to the largest institutional investors.

Empowerment

- Axxes Direct is seeking to change the narrative, providing RIAs, independent broker-dealers, and their clients the opportunity to invest alongside top-tier private equity firms seeking to deliver substantial returns through GP-Led Secondaries, Real Estate Development Projects, and Co-Investments.

Leveling the Playing Field

- By providing direct investment opportunities, Axxes is looking to rewriting the rules, “leveling the playing field,” and ensuring advisors have the same opportunities as the industry’s largest institutional participants.

Axxes Direct's Co-Investment Private Equity Opportunities

Continuation Vehicles

- Investment is at or near the end of legacy fund life

- GP desires to extend the hold period to increase growth, profitability, and ultimately investment value

- Fresh capital raised from new institutional managers; Axxes Direct entry point

Traditional Co-Investments

- Co-investments in new opportunities alongside leading sponsor in new portfolio acquisitions

- Potential to replace existing minority shareholders

- Additional growth capital

Opportunity: Significant Backlog of Available Deals

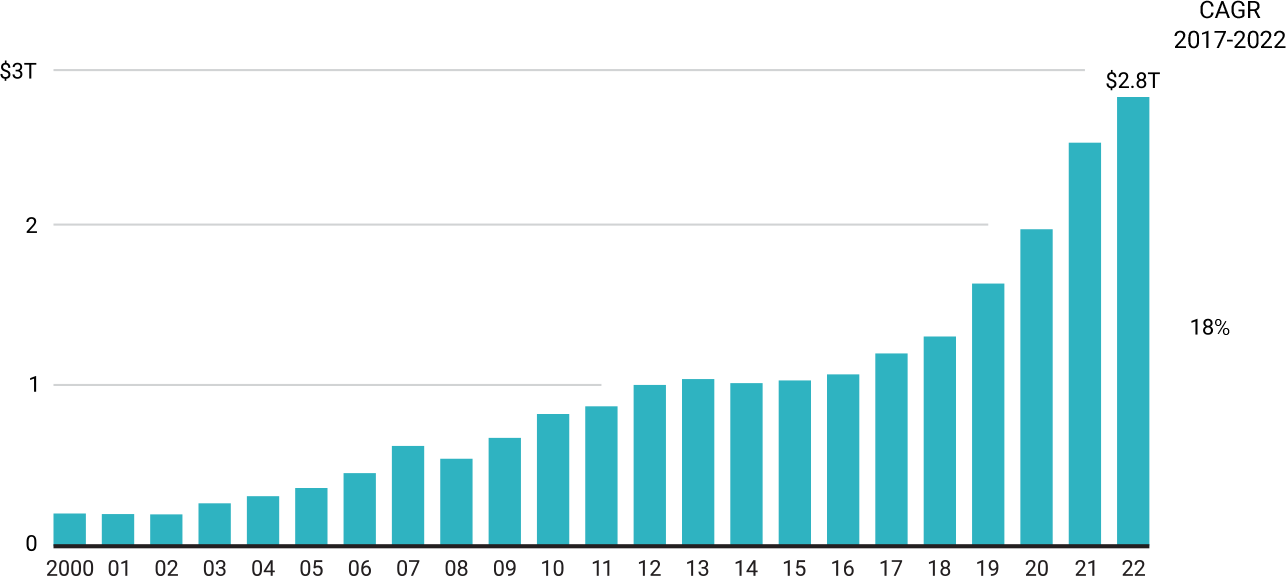

- The pool of potential private equity deals relevant for Axxes Direct is large. Buyout funds currently hold 26,000 companies worth $2.8 trillion in unrealized value versus 2,994 public companies currently1.

- Eight out of 10 companies are private. The number of companies currently held by private equity funds is unprecedented; this is our opportunity set for M&A and secondary transactions.

Global Buyout Unrealized Value2

1 Number of public companies in the Russell 3000 index, representing 96% of the investable U.S. equity market.

2 Note: Buyout includes buyout, balanced, co-investment and co-investment multimanagers.

Source: “Stuck in Place: Private Equity Midyear Report 2023,” Bain & Company.

Co-Investments Provide Greater Visibility and Shorter Holding Periods

- Co-investment vehicles enable investors to know exactly what they’re investing in as compared to primary investment funds that are typically “blind pools.”

- Compared to an investment in a primary equity fund, co-investment vehicles provide an ideal entry point along the J-curve, allowing for a more attractive risk-return profile, including shorter holding periods and possible quicker monetization.

J-Curve Mitigation

Traditional LP Investments

- Negative carry while creating future value

- Original Fund’s duration can be 10 years or longer

- Extension of Original Fund is difficult in current market

Axxes Direct Co-Investment Vehicles

- Enter at the value creation stage of ownership

- Lower risk entry point and greater visibility into growth/profitability trajectory

- Invest during the harvesting period (avg. hold of 5 years)